If you are a manufacturer and you inadvertently produce some defective products, then you have certain legal responsibilities in how you respond to the issue.

In this post we will explain your legal responsibilities when it comes to defective products, and discuss the role that insurance can play in helping you fix the issue.

Legal Responsibilities as a Manufacturer of Defective Products

Under The Consumer Protection Act 1987, manufacturers are liable for any harm caused by faulty or defective goods. Under this legislation, manufacturers would be held legally responsible for any losses or damages arising from faults or defects, regardless of whether you were originally at fault.

It is against the law to sell defective products in the UK. As a result, suppliers and retailers may also face claims of negligence in cases involving defective products. But in any case, the ultimate liability would always come down to the manufacturer.

When is a Product “Defective”?

A defective product is any product that does not function like it is meant to. We might also refer to products as “defective” when they have the potential to damage an individual’s property (e.g. if it carries unintended fire risks); or if they have the potential to cause illness, injury, or even death (e.g. if a food product accidentally contains traces of allergens or other harmful substances).

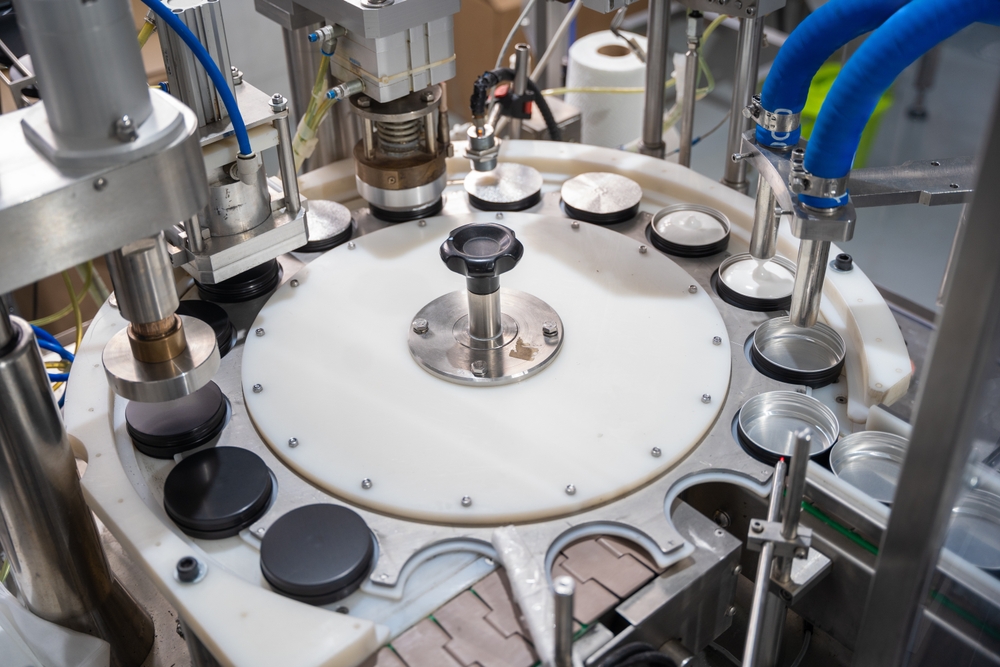

The defect might be found in the product’s design, or it might arise due to a manufacturing error. For instance, if a machine or a piece of equipment on your production line is not working like it should, the final product might not operate as expected.

The defect might also be found in the product’s packaging. It might contain misleading instructions, for example, or it might not properly warn of certain potential risks in using the product.

What Are The Penalties For Distributing Defective Products?

You will face severe legal, financial, and reputational consequences if you accidentally produce a defective product, and you fail to adequately respond:

- Legal action from customers, suppliers, and retailers.

- Fines from regulators.

- Personal injury claims and other legal action.

- Bad reviews and long-term damage to your brand’s reputation.

How Manufacturers Should Manage Defective Products

- Set clear terms and conditions. Outline exactly how you will manage returns, refunds, and repairs. This will help manage expectations which could ultimately help you avoid disputes.

- Respond quickly. You need to act as soon as you become aware of the defect, whether you notice it yourself, or you receive a complaint from a supplier, a retailer, or a customer. At this point it is important to collect evidence and keep records of all communications, as you may ultimately have to demonstrate how you managed the issue.

- Offer the correct response. Your exact legal responsibilities may differ depending on the particular situation you are facing. You need to follow the law when it comes to offering refunds, repairs, or replacements. For more information, check the Consumer Protection Act and the Sales of Goods Act.

- Review your quality controls. If you accidentally manufacture a defective item, you should thoroughly review your processes, including your quality control systems, to determine just how this defect came about. This will help you avoid producing any further defective items in the future.

Reducing Defects in Manufacturing

- Quality control is everything. You should implement robust quality control procedures at every step of the manufacturing process. These procedures should be capable of identifying errors as soon as they arise, so that you can address any potential issues immediately.

- Train your employees. Your employees should know how to spot any potential issues that could lead to defects, and they should know how to respond effectively.

- Set policies and procedures. You should know in advance exactly how you will respond to a defective product issue. Make sure you understand your legal requirements in responding to different types of defects, whether it is a harmless design flaw or a serious error that could potentially cause harm. The better you understand your legal responsibilities, the faster and more effectively you can act when you need to.

The Role of Insurance in Product Defects

Specialist manufacturing insurance can include product liability insurance. This can cover you for all the expenses that may arise should you manufacture a defective product, including product recall fees, the costs of notifying suppliers, retailers, and customers, and any potential legal fees or compensation payments that may follow.

Read our full guide to what manufacturing insurance can cover.

James Hallam is an independent Lloyd’s broker with a dedicated team of experienced insurance brokers. We are committed to protecting your manufacturing business, and we can help you ensure you are fully covered for all risks relating to defective products.