Physio First

Trust leads to more trust

James Hallam is an independent Lloyd’s broker with a dedicated team of experienced insurance professionals who care about protecting your business.

Trust leads to more trust

James Hallam is an independent Lloyd’s broker with a dedicated team of experienced insurance professionals who care about protecting your business.

Physio First Members

Make sure your healthcare business is fully insured

If you run a healthcare business, it is essential to have complete insurance cover to fully protect your company. Many clinicians think their company is covered if each practitioner has individual insurance, but this isn’t usually sufficient.

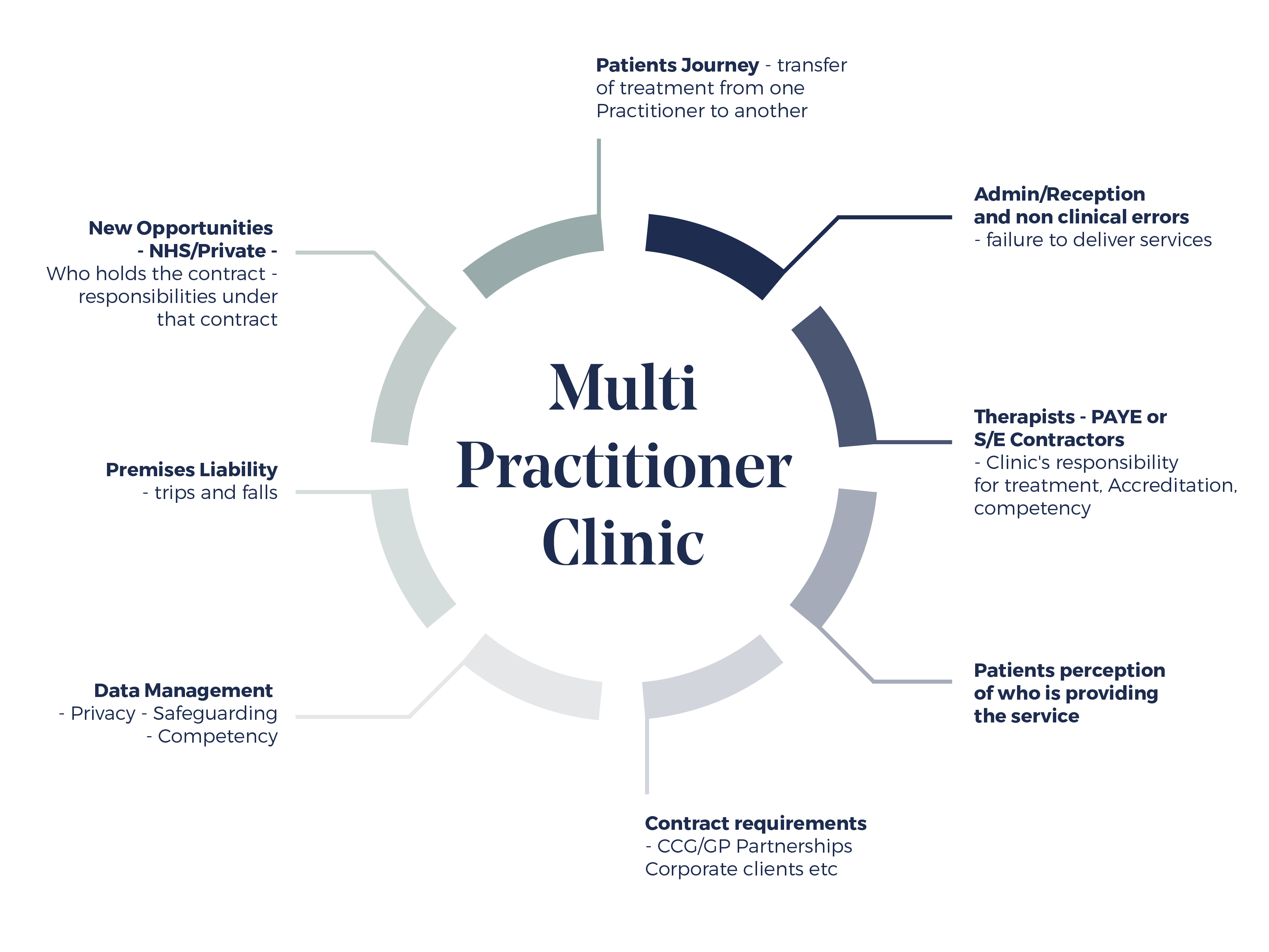

Corporate organisations delivering physiotherapy and other healthcare services face several exposures and challenges including legal liability for the actions of its staff and representatives.

It is important to understand that when establishing a corporate entity, it is crucial to recognise that it becomes a separate legal entity and in turn becomes susceptible to claims and grievances regarding the services it offers. By relying solely on clinicians’ policies they may inadvertently leave the corporate entity vulnerable to matters that could result in a claim against the company.

Errors can arise from adverse events which may stem from the corporate entity’s actions or may solely be their responsibility. This could also mean that the clinicians’ insurers might not provide cover due to specific terms and conditions within their individual policies.

Whose liability is it?

When setting up a corporate entity, you are responsible for the running of the business and there are potential exposures you could face.

Reliance on Individual Insurance

Many physiotherapists have their own individual insurance through a Group Facility via their CSP membership. While CSP and its insurers support members in respect of claims and complaints arising from their errors and omissions, this cover doesn’t extend to a company’s/employer’s own vicarious or direct exposure.

However, the CSP provides some cover for small businesses where all clinicians and shareholders (with the exception of Silent Shareholders) are CSP members, all services fall within the scope of Physiotherapy Practice and the turnover of the business does not exceed £200,000 in the last financial year. Nevertheless, some gaps may still remain.

This is where we can help because we have a clear understanding of the environment in which you operate and are also very familiar with the ever-changing landscape of NHS services, CNSGP indemnity for Primary Care services and CNST indemnity for secondary care services.

Why James Hallam?

James Hallam ProMed, are the specialist healthcare division of James Hallam Insurance Limited, bringing a wealth of experience in healthcare liability insurance. We collaborate with leading insurers in the industry to serve clients across the healthcare sector, with a particular focus on the Allied Health Care Sector.

Physiotherapy businesses looking for tailored insurance solutions will find that we have the expertise to understand their specific risks and requirements. By working closely with you, we can provide the right cover at the right price, ensuring there are no gaps in protection.

We offer cost effective solutions with exceptional service for all your business insurance needs including:

- Medical Liability Insurance

- Public Liability/ Products Liability

- Employers Liability

- Office and Surgery Insurance

- Management Liabilities

- Cyber Liability

We are here to help you.

Call us on 02031 488995 or email promedschemes@jameshallam.co.uk

James Hallam ProMed offers cost effective solutions with exceptional service for all your business insurance needs including:

Medical Liability Insurance

Cover is designed to protect the business against its legal liabilities arising from the clinical services provided, including liabilities the company faces for the acts of its clinicians. It can be extended to include other risks such as Public, Products and Employers liability.

Our products acknowledge:

- Your risk management and risk controls

- The contracts you have in place

- The ability of insurers to pass the claim back to the clinician

- The accreditation process you undertake

- The controls and governance you have in place to minimise your exposure

- Along with premiums which are consequently competitive and cover that aligns to your specific needs

Management Liability Insurance

Every business has a bespoke need for Management Liabilities. It responds to your failure to act diligently as the Director and Officer of a corporate organisation in the fulfilment of your duties as a director/officer of the company. We can discuss your needs and design a suitable cost effective and appropriate solution for Directors and Officers Liability Insurance (D&O). This cover will reimburse the defence costs incurred by board members, managers, and employees in defending against claims made by shareholders or third parties for alleged wrong doing.

All private or public companies that have a board of directors should also have Director and Officer Insurance. Some of the exposures that directors and officers are most vulnerable to include: regulatory actions, misrepresentation allegations, securities litigation, and breaches of fiduciary duties.

Cyber Liability

We recommend cyber solutions that are tailored to the healthcare sector. Cyber exposures are not covered under most commercial insurance policies and could leave you out of pocket.

Now with the rise in cybercrime it is essential to review your Cyber policy to ensure you are protected, as we move rapidly towards the digitalisation of healthcare processes. The cyber market has evolved, and we work in a proactive way to stay ahead of the criminals and support you and your business so you do not have to worry about the long term impact a cyber-attack could have on your clinic.

Cyber Insurance provides financial protection and peace of mind in the face of growing cyber threats, helping businesses manage the costs associated with breaches and other cybersecurity incidents.

Key Features:

- Replacing data corrupted/destroyed by network failure or first/third party intervention

- Loss/extra expenses resulting from when a network is interrupted by attack

- Covers criminal, malicious insiders, and denial of service (DOS) attacks &extortion

- Fines and penalties where insurable by law

- Disaster recovery activation costs

- Reputational damage

How can I apply?

Please contact 02031 488995 or email Promedschemes@jameshallam.co.uk and one of our advisors can discuss your needs in more detail.

Office and Surgery Insurance

As a partner, director, business owner, or manager you will have a duty of care to your employees, suppliers, and the public to have appropriate cover in place.

You will understand your clinic better than anyone else, so we work with you to offer specialist packages that cater for your unique business needs. Office and Surgery Insurance includes full protection for your business assets and revenue.

When it comes to deciding what covers and limits are required for your clinic, this can become very overwhelming. Every clinic is unique, this is why we have designed a flexible policy that will tailor to your needs and completed online so you are in full control.

Key Features

- Property damage for your business contents, stock, and computer equipment

- Protection for loss of income over a selected indemnity period

- Liability claims from third parties or employees.

- Optional covers; legal expenses, property away from the premises, personal accident

- Computer breakdown

- Access to the online platform that gives you access to quote at a time 24/7

- 0% interest direct debit offering

Litigation can come from anywhere. Employees, shareholders, your company, creditors, regulators, customers, competitors, the Government, other directors and suppliers or anyone else who feels they have suffered a loss arising from the Director wrongly acting in their position, can potentially sue you.